Term Insurance is the most basic and affordable type of life insurance. It offers financial coverage for a specific number of years or a fixed term (i.e., the policy term) in exchange for regular, fixed premiums. A term insurance plan protects your loved ones’ financial future in case you pass away. The payout can cover various expenditures like children's education, loan repayments, daily expenses, maintaining living standards, and more. So, buy a good term life insurance policy today and make sure your family’s future is secure.

Life Cover Starting @ just ₹18/day*

Change Your Policy Term

As per your life stage and commitments

Hassle-Free Claim Settlement

99.38% Claim settlement ratio*

Smart Income Tax Savings

Save up to ₹54,600* on your taxes

Term insurance is the purest form of life insurance. It protects your loved ones in case you pass away during the policy term. Having a term plan ensures that your family receives a lump sum amount (called the death benefit). This money can help them manage daily expenses, pay off loans, and achieve important life goals.

With a regular term insurance plan, you don’t get any money back if you live beyond the policy term. For example, A 30-year-old non-smoker male takes a ₹1 crore term insurance policy for a 30-year term. The monthly premium is around ₹832. If he passes away during the policy term, the nominee will receive ₹1 crore. If he outlives the term, there is no payout under a regular term insurance plan. However, for those who prefer not to let the premiums go without any return, there’s an option called term insurance with return of premium (a type of term insurance). With this plan, if the policyholder outlives the term, the total premiums paid are returned.

Looking for the best term insurance in India 2025? Buy one of India’s best term insurance plans starting at just ₹18/day. With the ACKO Life Flexi Term Plan, you get complete flexibility to customise your coverage amount and policy term to match your changing life goals — 99.38% claim settlement ratio, 100% digital and hassle-free.

Want to know more? The table below compares the ACKO Life Flexi Term Plan with traditional term insurance plans, highlighting key differences in flexibility, premium payment options, and value-added features, so you can decide which is the best term insurance plan in India 2025 for your needs.

| Parameters | ACKO Life Flexi Term Plan | Traditional Plans |

| Claim Settlement Ratio | 99.38% | Varies from 98-99% |

| Policy Adjustments | Instant changes via app | Depends on the medium ( offline and online ) |

| Increasing Cover Option | Yes. No restrictions* | Restricted to life big events such as marriage, welcoming a child, etc. |

| Cost Savings | Up to 40% savings* | Costs grow over time 📉 |

| Future Premium Hikes | Age wise premiums remain the same | Age wise Inflation adjusted premium |

| Customisability | Flexible coverage/term | Rigid, limited options |

| Riders | Offers valuable riders to enhance protection | Riders may be provided depending on the plans |

| Length of Claim Form | Easy, digital, and short | Moderately long/Very long/Not available online |

| Option to Exit the Plan | Yes* | Approx. 80% of insurers provide |

| Digital Experience | Fully online, app-based 📱 | Often requires offline processes, paperwork, or branch visits |

| End-to-end Digital Support | Yes | Depends on the insurer |

| Home Pickup of Claims | Yes, ACKO team will personally collect the documents | Roughly 20% of insurers provide |

| Free Will Creation | Yes | No, Generally does not offer integrated will creation services |

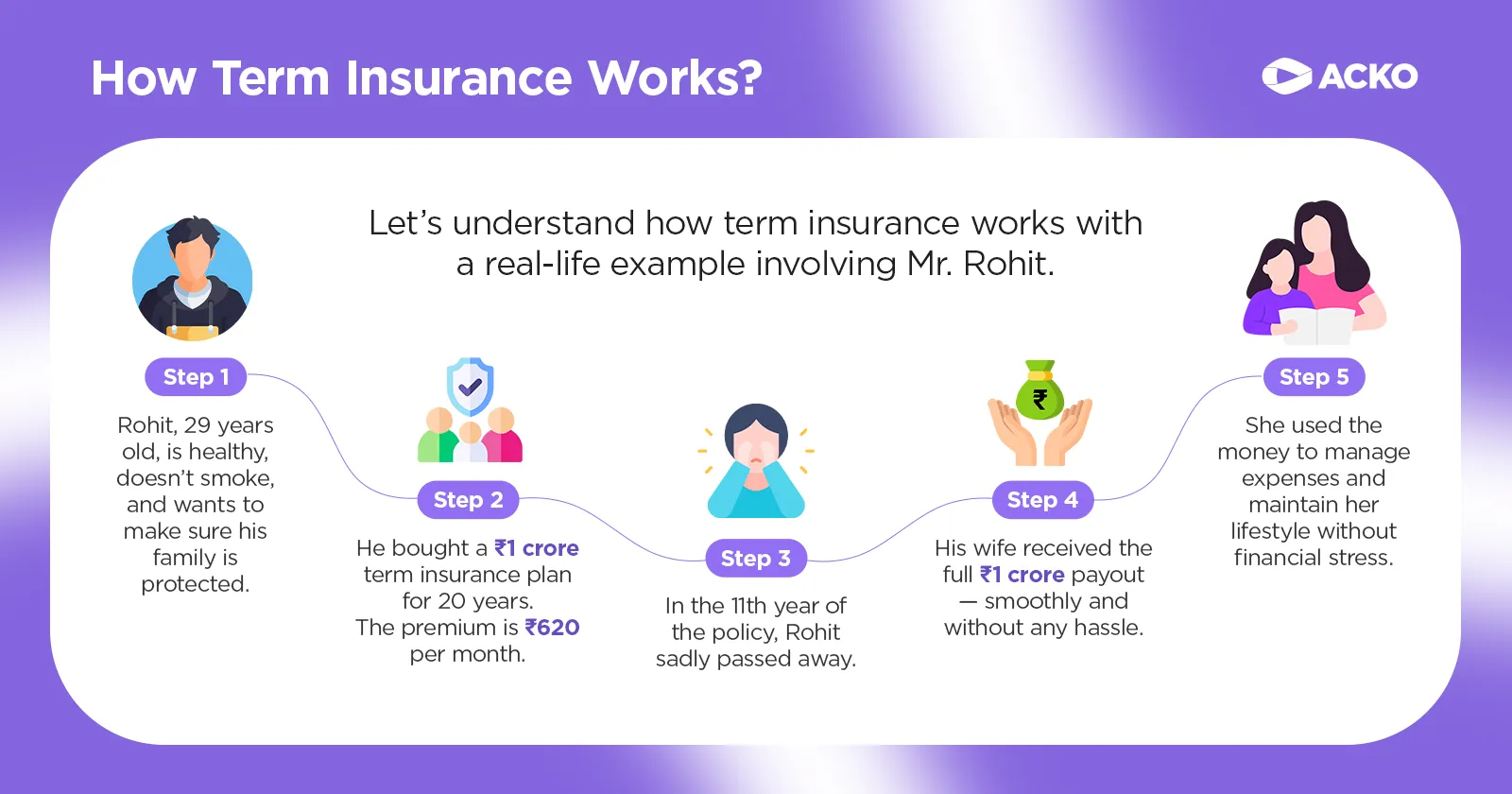

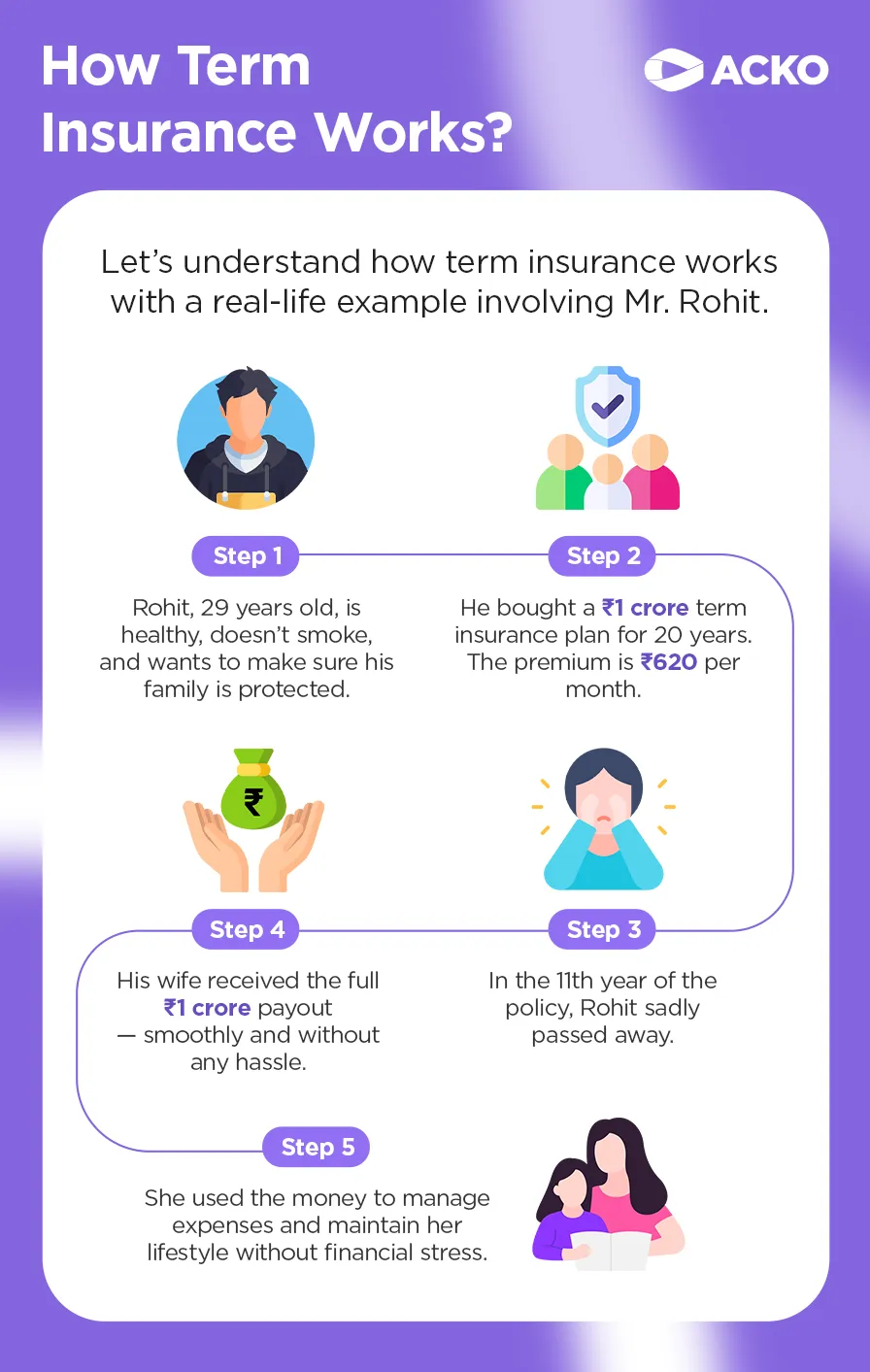

Here’s how term insurance works in simple steps to ensure peace of mind for your family.

Buy a term insurance plan to make sure your family, like your spouse, children, or parents, gets financial support if you pass away during the policy term.

Decide how much money your family would need, how many years you want the coverage for, and how you’d like to pay: monthly, yearly, or in one go.

If you pass away during the policy period, the term insurance plan ensures your family receives financial support.

Your nominee gets the full cover amount - no tax, no delays.

The money can be used for living expenses, loan payments, school fees, or anything else they need.

ACKO’s term insurance offers flexible, customisable features designed to support different life stages and financial goals.

| Categories | Specifications |

| Sum Assured | ₹10 Lakhs to up to ₹90 Crores |

| Entry Age | From 18 years to 65 years |

| Tax Benefits | Save up to ₹54,600* on taxes |

| Claim Settlement Ratio | 99.38% |

| Affordable Premiums | Term Life Cover Starting @ just ₹18/day* |

| Claim process | Fully digital, simply upload the necessary documents on the app. |

| Death Benefit | Available |

| Critical Illness Cover | Available |

| Accidental Total Permanent Disability | Available |

| Accidental Death Benefit | Available |

| 100% Dedicated Claim Assistance | Available |

| Policy Term Flexibility | Available |

| Customisable Policy Coverage | Available |

Term insurance should give you peace of mind, knowing your family is protected. And getting covered should be just as easy.

We’ve made the buying process simple, quick, and transparent — with zero confusion.

ACKO Life makes it easy to file a term insurance claim. There’s no paperwork; you can do it anytime on the app, and a support team is always ready to help.

The GST Council is considering a significant tax relief on term life insurance premiums. India may soon waive the 18% Goods and Services Tax (GST) currently levied on term life policies — a move aimed at making life insurance more affordable and accessible. Backed by the Insurance Regulatory and Development Authority of India (IRDAI), the proposal positions insurance as a public good, particularly crucial in a country where life insurance penetration remains below 4%.

If approved, the exemption would apply to all term life policies, regardless of the policyholder's age or coverage amount.

Source - https://www.moneycontrol.com/news/business/personal-finance/gst-may-be-removed-on-term-life-and-senior-health-insurance-here-s-what-it-means-for-you-13308249.html

You need a term insurance plan because it helps protect your family, pay off debts, and handle future expenses if something happens to you. Here are the key reasons to consider getting one:

Purely designed to offer a payout to nominees in your absence during the term. It doesn't grow money over time like whole life insurance.

One of the most affordable types of life insurance. You pay a small amount regularly, and your family gets a comprehensive payout if you pass away during the policy term.

Ensures your family won't struggle financially if something unfortunate happens to you. Get a lump sum (sum assured) to cover expenses like daily living, education, and even outstanding loans.

Knowing that your loved ones are safe can provide you with peace of mind and free up your time for the other aspects of life.

Tax benefits are available under sections 80C & 80D of the Income Tax Act 1961. It is a smart income tax-saving option, allowing you to save up to ₹54,600 on your taxes*.

For big debts, such as house mortgages or personal loans, term insurance will ensure that the debt amount is paid off and not passed on to your family members.

Choose the coverage amount (sum assured) based on your family's needs and budget. Decide how long you want the coverage to last.

One of the key factors in choosing the right term life insurance plan for your family’s financial protection is selecting the appropriate sum assured. Here are some of the most common coverage options to explore:

A simple guide to choosing the right plan with the best coverage for your family’s long-term protection.

Determine your family's expenditures, loans, and future objectives to determine the appropriate coverage.

Pick a sum assured (payout amount) that can meet your family's financial requirements.

Choose a term that takes you through until your financial dependents are on their own.

Search for plans that provide good coverage at reasonable premiums.

Extend coverage with riders such as critical illness cover or accidental death benefit.

Opt for an insurer that has a good claim settlement ratio to ensure ease of experience.

Plans purchased online tend to be less expensive and also include extra convenience.

Rated 4.6/5 with over 13377 reviews on Google

See all reviews

Buying a term insurance plan is a practical option for everyone, especially those who are financially dependent, to secure their family’s finances in case something unfortunate happens. Here’s a list.

Buying term life insurance when you're young and healthy can be cheaper. It's like locking in a good deal for the future.

If you're the one who earns for your family, term life insurance is essential. It ensures your family won't face financial difficulties if you're no longer there to support them.

If you have loans or debts, like a home/personal/car loan, term life insurance can cover those debts so your family doesn't get burdened.

If you're looking to save on income tax while securing your family's future, term life insurance is a smart choice. Premiums paid are eligible for tax deductions under Section 80C, and the payout to your family is tax-free under Section 10(10D).

Homemakers play an important role in running the household and supporting the family. Term insurance for non-working spouses helps ensure that daily needs like childcare, groceries, and household support are taken care of, in case of an unforeseen event.

In today’s workforce, women stand shoulder-to-shoulder with men. Term insurance for working women offers tax savings and helps secure a family's financial future. Additionally, many plans include riders, such as critical illness coverage, for life-threatening illnesses commonly affecting women.

When you're beginning your married life, term insurance provides financial protection for your spouse in case something happens to you. Buying early also means lower premiums.

If you're a single parent, your children depend on you entirely. Term life insurance can give you peace of mind, knowing that your kids will have financial support if something happens to you

If you want to leave your heirs and inheritance or financial legacy, term life insurance can help ensure they receive it.

If you own a business, term life insurance can be crucial to ensure the smooth transition of your business or to cover business debts in case something happens to you.

Many Indians support their parents or siblings financially. A term plan ensures that your dependents won’t be left helpless in your absence.

You want to make sure your family is financially secure if something happens to you. But you need to figure out how much coverage you need or how much it will cost. That's where a Term Insurance Calculator comes in.

In simple terms, a Term Insurance Calculator helps you determine how much insurance you need and how much it will cost. It's like a virtual assistant that takes the guesswork out of protecting your loved ones financially.

Provide basic information about yourself, like age, gender, and how much money you want your family to receive if you pass away.

Answer a few simple questions about your habits and health condition.

Then, the calculator does some quick maths and gives you an estimate of how much you'll pay for the insurance each month or year. It also tells you how long the coverage will last (usually a specific number of years).

Let’s examine how term insurance can protect a family’s future using Mr. Suresh as an example, a regular, responsible family man.

Mr. Suresh was a 32-year-old software engineer living in Bengaluru. He was the sole earning member of a family of four: his wife and two young children. He had many dreams to fulfil. But life took a tragic turn when he passed away suddenly. What made all the difference was that Mr. Suresh had a ₹1 crore term insurance plan.

Now, let’s look at how that one decision protected his family’s future:

His wife received a ₹1 crore payout. This helped replace his income and cover essential expenses like rent and groceries, just like his salary did.

Estimated monthly expenses for a 4-member middle-class Indian family range between ₹45,000 and ₹70,000, according to various 2024 estimates and surveys.

Mr. Suresh had loans, like a home loan and personal/car EMIs. His term plan helped pay them off, so the family didn’t lose their home or fall into debt.

With per capita borrower debt rising by nearly 23% over the past two years and non-housing debt representing around 55% of household liabilities, financial pressure on Indian families is growing.

His kids, aged 5 and 9, had money saved for school and college. Because of the term plan, they didn’t have to rely on luck or donations.

As per a study covering 2014–2018, the cost of engineering education in India’s top colleges averaged ₹15–18 lakh, while MBA programs from tier 1 and tier 2 institutes ranged between ₹18–20 lakh.

His wife used some of the money to start a small business at home. This helped her earn on her own and take care of the family.

Today, many women entrepreneurs in India are primary earners in their households. This reflects a strong shift toward financial independence and greater responsibility.

Term insurance is a simple and popular type of life insurance. It’s affordable, easy to understand, and offers a low entry age and debt protection. It also provides flexible premium payments, customisable coverage, and payout options. Here’s a quick look at the key features and benefits of term insurance plans.

You can get term insurance from age 18. Starting early means lower premiums and longer coverage.

Term insurance provides coverage for a stated or specified period, such as 10, 20, or 30 years. If the insured lives beyond the stated term, then the policy expires and pays no benefit.

Term insurance is quite simple in nature, making it easier to understand and purchase compared to other types of life insurance.

Options to add additional protection through riders like accidental death benefit, accidental total permanent disabilities, and life insurance critical illness. These riders add an extra layer of financial protection on top of the sum assured provided by the term plan.

The amount of coverage can be increased or decreased in most cases according to your needs and financial responsibilities (e.g., paying off a mortgage or dependents).

Term insurance is usually more affordable than whole life or universal life because it does not include a saving or investment component. The premiums are normally lower.

A conversion option means that you may convert your term policy into a permanent life insurance policy, such as whole life or universal life, without showing evidence of insurability. This is particularly useful if your health changes or you decide later in life that you might want lifetime coverage.

When paying for term insurance, the premiums are fixed for the duration of the term. That is to say, the amount paid for protection is constant throughout the term. Hence, locking in these premiums early in life is a smart financial move.

There are term insurance policies that allow renewal of the policy after the term is over, generally at an increased premium. The good thing here is that you can extend the coverage without a new medical exam, although the premium will surely increase as you get older.

When the policyholder dies during the period known as the 'policy term,' a tax-free death benefit is paid to their named beneficiaries.

Term insurance does not build any cash value or investment component; it is purely a protection policy designed to pay a death benefit.

There are different payout options in term insurance to match your family's needs. Term insurance payout options can include a lump sum, monthly income, or a combination of both.

Your family gets all the money at once. This is the most common option available and gives them immediate access to the entire amount.

Instead of one big payout, your family receives a fixed amount every month for a set number of years. It could be 5 years, 10 years, depending on the policy details. This helps with regular household expenses

The monthly amount increases every year. This helps your family handle rising prices and living costs.

Part of the money is paid upfront as a lump sum, and the rest is given as monthly income over a fixed period. This gives your family quick support and steady income.

Remember to choose the right death benefit payout option in your term insurance plan. To do that, first check what options your insurance company is offering. Then, think about what suits your family best. For example, do you have any loans to pay off? Who is your nominee, and can they manage money well? Accordingly, select your term insurance payout option wisely.

The benefits of buying term life insurance include affordable premiums, high coverage, flexible payout options, and financial security for your loved ones in case of your untimely passing. It’s a smart and simple way to protect your family’s future.

Term insurance offers a high coverage amount. If you pass away, this large amount will be paid to your family. This ensures they remain financially secure.

The premium payment is fixed and, hence, easier to budget. You know exactly how much you’ll pay, which makes it simple to plan your finances.

Ensures that your nominees have a means of handling the living requirements, debt repayments, or maintenance of their lifestyles in your sudden death.

Another perk is that you can get tax benefits. The premiums you pay are tax-deductible under Section 80C of the Income Tax Act as per the tax regime you opt for. Your family's payout is usually tax-free under Section 10(10D).

It’s important to understand the various types of term plans, as each works differently. In this section, you'll learn some of the common types of term insurance policies in India, the key features of different types of term plans, and who they are best suited for.

This is the simplest and most widely chosen type of term insurance. With a level term insurance plan, you pay a fixed premium every year, and if something unfortunate happens to you during the policy's term, your family gets a lump sum amount (the sum assured).

Buying increasing Term Insurance is a smart step because it takes inflation into account. Your coverage amount (the sum assured) increases every year by a certain percentage. So, it keeps pace with the rising cost of living.

Imagine you have a home loan or some other big debt. This type of term plan is designed for that. As you pay off your debts, the coverage amount decreases because your financial responsibilities are decreasing too.

With Return of Premium Term Insurance, if you outlive the policy term, you get back all the premiums you paid over the years. It's like getting a refund, but it's only if you're alive at the end of the term.

This one is flexible. You can start with a basic term plan and later convert it into a more comprehensive life insurance policy, like an endowment or whole life plan. It's like upgrading your insurance.

Sometimes, employers offer Group Term Insurance to their employees as part of the employee benefits package. It covers a group of people under a single policy, and the premiums are usually lower.

Joint Term Insurance is designed for couples. You and your spouse can be covered under one policy. If either of you passes away, the surviving spouse gets the benefit. It's a way to ensure financial security for the family.

A term insurance rider is an optional add-on to a term life insurance policy that offers additional benefits and enhanced coverage. There are various types of term life insurance riders available in India, such as critical illness rider, accidental death benefit rider, critical illness and more.

You can choose riders based on what you need and what you can afford. Riders cost a little extra, so pick only the ones that give you useful benefits without making the premium too expensive.

Add a rider to your base plan for extra protection and greater peace of mind.

Easily get financial protection against accidental death, accidental disabilities, critical illness, etc.

Riders are designed to match different personal and family needs under term insurance.

Let's take a closer look at some of the important term riders offered by ACKO. You can easily add these unique term insurance riders to your ACKO Life Flexi Term Plan.

ACKO Life Critical Illness Benefit Rider is an extra layer of protection for your term insurance. If you get seriously ill, this rider can provide you with a large amount of money to help you through a tough time.

Another key benefit of this rider is that ACKO waives off all future premium payments due for your ACKO Life Flexi Term Plan. We cover 21 critical illnesses, including life-threatening common illnesses among women, such as breast cancer, cervical cancer, fallopian cancer and ovarian cancer.

List of Covered Critical Illnesses:

| ✔️ Cancer of Specified Severity | ✔️ Myocardial Infarction (First Heart Attack Of Specific Severity) |

| ✔️ Open Chest CABG | ✔️ Open Heart Replacement Or Repair Of Heart Valves |

| ✔️ Coma Of Specified Severity | ✔️ Kidney Failure Requiring Regular Dialysis |

| ✔️ Stroke Resulting In Permanent Symptoms | ✔️Major Organ /Bone Marrow Transplant |

| ✔️ Permanent Paralysis Of Limbs | ✔️ Motor Neuron Disease With Permanent Symptoms |

| ✔️ Multiple Sclerosis With Persisting Symptoms | ✔️ Benign Brain Tumor |

| ✔️ Blindness | ✔️ Deafness |

| ✔️ End Stage Lung Failure | ✔️ End Stage Liver Failure |

| ✔️ Loss Of Speech | ✔️ Loss Of Limbs |

| ✔️ Major Head Trauma | ✔️ Primary (Idiopathic) Pulmonary Hypertension |

| ✔️Third Degree Burns | |

ACKO Life Accidental Death Benefit Rider is one of the most affordable riders, purely designed to protect your family with an additional amount of money if your death is caused by an accident.

Accidental Total Permanent Disability Rider is designed to protect your financial well-being in case a major accident leaves you permanently unable to work or care for yourself. It provides an extra amount to cover daily expenses. Additionally, we will waive off all future premiums of your ACKO Life Flexi Term Plan.

Buying a term plan online is quick, simple, and convenient. You can easily compare plans, choose what suits you best, and skip the paperwork. When you buy from ACKO, you get a smooth digital experience, transparent pricing, and helpful support.

Here are some of the key benefits of buying your term insurance plan online:

Buying term insurance online at ACKO is pretty easy. You need not visit any office or meet any agents; complete the process anytime, anywhere, and at your own pace.

Online term insurance plans at ACKO are pretty reasonably priced. With no middlemen or agents, you will be able to easily compare quotes from various providers and select the plan that fits your budget.

Buying term insurance online from ACKO will show all the details and terms of the policy on our website. No hidden charges or confusing jargon-just straightforward information, pretty much like reading a book with no fine print.

There is no tedious paperwork and meetings. You can get the whole process done a lot faster at ACKO, sometimes in just a few minutes.

You may review every feature of the policy, understand its details, and decide accordingly on your own in due course.

ACKO secures all your personal and financial information with advanced encryption and secure payment gateways. Your data is safe and secure.

The process to buy the ACKO Life Flexi Term Plan is simple and straightforward. Follow the steps below:

Initiate the purchase journey via the widget on the website/app.

Select the plan

Answer the questions to determine eligibility and premium.

Pay the premium online.

Receive the policy via email or download it from the app.

Note: This is a generic process; the exact steps can vary depending on the chosen plan and other details.

Watch this video to learn everything you need to know about ACKO’s Term Insurance Plan.

ACKO Life Flexi Term Plan is a modern, flexible, and customer-centric solution for long-term financial protection. It not only offers inflation protection through premium lock-ins but also provides a unique level of policy flexibility unmatched by most traditional insurers. The convenience of managing the entire policy lifecycle digitally adds to its appeal, particularly for individuals who prioritise ease of use and adaptability.

ACKO offers a fully digital policy management system. Policyholders can easily make any policy adjustments (endorsements) such as:

Changing personal details (address, phone number)

Adjusting the Sum Assured or Policy Term

Adding or modifying riders

Updating nominee details and payout modes

Raising claims—all via the mobile ACKO App.

Many traditional insurers require offline, time-consuming processes for policy adjustments, often involving paperwork or visits to branch offices. ACKO’s completely digital process offers unmatched convenience, especially for tech-savvy consumers.

A Real-Life Insurance Example:

Meet Rahul, who has an annual income of 10 lakh. He got married at 30 and bought a 1 crore coverage ACKO Flexi Term Life Plan for his spouse, Rina. At 35, with two kids (Nirvana and Kavir) and a 50 lakh home loan, he increased the coverage to ₹2 Crore as his responsibilities increased. By 45, after repaying the home loan and accumulating a substantial income corpus for his kids' education, he reduced coverage back to 1 crore. This shows how ACKO Life Flexi Term Plan adapts to individuals' changing life circumstances.

When you first buy ACKO’s Flexi Plan, the premium rates for different coverage amounts are fixed based on your age at the time you start the policy.

In the last 4 years, term insurance premiums have increased by more than 40% on average. ACKO's Life Flexi Term Plan can potentially help you save up to 40% on premiums in the long run, assuming these historical price trends continue. Most market plans do not offer a similar lock-in mechanism for future premium hikes related to sum assured increases.

A term insurance plan works in the simplest manner, ensuring a hassle-free journey experience for you!

Choosing the best term life insurance at the right moment can make all the difference. Discover 6 important life scenarios where purchasing term insurance is a wise financial decision.

The question of when to buy term life insurance is determined by your needs and financial objectives. However, it is important to understand that when you buy term insurance early, the amount you pay (called the premium) is much lower.

The example below shows how a 25-year-old, 30-year-old, and 35-year-old man pay different premium amounts for the same ₹1 crore term insurance plan. This shows why buying early is important; it helps you save more on your premium.

Choosing the right term insurance cover is important. It helps protect your family’s future if something happens to you. Here’s a simple way to figure it out:

A good rule is to choose a cover that is 10 to 15 times your yearly income. For example, if you earn ₹5 lakhs a year, your cover should be around ₹50 to ₹75 lakhs.

Human Life Value (HLV) is the estimated total income you would earn for your family during your working years, adjusted for inflation, liabilities, and future goals.

This way, your insurance will give your family enough money to live comfortably even if you are not around.

Choosing the best term insurance plan in India can feel confusing. You want something that fits your needs just right. Here are the steps to help you pick the right term insurance plan for you.

Yes, NRIs (Non-Resident Indians) can buy term insurance for NRI in India. It is easy and safe.

Buying a term insurance plan in India is a smart choice for NRIs (Non-Resident Indians). Here are some of the benefits of buying NRI term insurance:

Term plans in India are high affordable, especially when bought at a younger age.

You can get a high sum assured (like ₹1 crore term insurance, 5 crore term insurance, or even 20 crore term plans at affordable premium rates to protect your family’s future. Some insurers offer a GST waiver for NRIs as per the tax laws.

The claim amount received by your nominee is tax-free in India under Section 10(10D) of the Income Tax Act.

Your nominee in India can easily file a claim and receive the money.

Term insurance gives financial help to your family. However, it’s important to know what it does and doesn’t cover. Always read the policy document to understand the full list.

| What is Covered in Term Insurance: | What is Not Covered in Term Insurance: |

| Death Due to Illness | Death Due to Suicide in the First Year |

| Death Due to Accidents | Death from Risky Activities |

| Death Due to COVID-19 or Other Pandemic Diseases | Death from Criminal Acts |

| Death Due to Natural Causes | Death Due to pre-existing illnesses (undeclared) |

The right term for an insurance policy is based on your needs and situation. Consider a few of the following when pre-determining how long your term should last

Consider how long you'll have certain financial responsibilities, such as a mortgage or dependent children. For example, if you have a 30-year mortgage, it might make sense to opt for a 30-year term policy to ensure coverage until the mortgage is paid off. It is wise to extend your coverage until you're 70 years old to ensure comprehensive protection.

If, for instance, the aim is to replace income for your dependents if something were to happen to you, you may want a policy that can last up until they become financially independent or up until they are not relying on your income anymore.

Policies with longer terms generally tend to be more expensive, so balance your needs with your budget and select a policy term accordingly.

To buy a term insurance plan in India, you need a few simple documents. These help the company verify your details.

ID Proof

Address Proof

Age Proof

Income Proof

Medical Reports (if asked)

Nominee KYC Documents

To make a life term plan claim, you need to keep some important documents ready. Here is a list of the documents you may need.

People make a lot of mistakes for various reasons when buying term insurance online. Here are some common mistakes you should avoid while buying term insurance in India:

The biggest mistake is incorrectly calculating the coverage requirement. Factor in outstanding debts, future expenses such as children's education, and income replacement. If underestimated, this might result in less than adequate coverage for dependants.

Choose the policy duration that coincides with your financial liabilities. In other words, if you have a mortgage of 20 years, you'd probably want your policy to last at least as long as the mortgage.

Choosing insurance coverage until you’re 70 is a smart choice. Extending it beyond 70 can make your premiums (the amount you pay) much higher.

Most term insurance policies are renewable, but the premiums at renewal may be higher. Understand what the renewal provisions are, and how they compare to buying a new policy at a later date.

Compare several quotes from different insurers to ensure that you get the best rate and terms for your needs.

Read the policy details carefully, and check the exclusions, limitations, and conditions that may apply to your coverage.

Consider how the value of your coverage may erode over time and additional coverage is needed to account for this.

Life circumstances change. Periodically review your policy and update it to determine whether it meets your needs.

While the cost is an important factor in nearly anything, sometimes the cheapest policy isn't always the best. Make sure the insurer has a good reputation in terms of claim payouts and service to customers.

Another mistake may be failing to research the insurance company's financial rating. An insurer that is financially stable is more likely to pay claims when they arise.

Many term policies have the option to convert to a permanent policy without a medical examination. This can be of great value if you believe that your needs might warrant permanent insurance protection in years to come.

See if the policy offers additional riders, such as critical illness coverage or accidental death benefits that apply to you.

Understanding these common terms will help you make better choices when buying a term insurance plan in India. Here is a list of some of the most important term plan terminologies.

The regular amount agreed to paid (monthly, quarterly, half-yearly or annually) by the policyholder.

Amount paid by the insurer when the policyholder outlives the policy term.

Amount paid to the nominee if the policyholder passes away during the policy term.

Total duration of financial protection and benefits.

Person covered under the policy.

The policy provider that accepts the risk and pays for losses during the policy term.

Amount the insurer pays during a claim.

Add-ons for extra protection, like Accidental Death or Critical Illness.

A window/time to pay premiums after the due date before the policy becomes inactive.

Premiums are not paid, and the policy is not revived within the grace period, leading to a loss of coverage and no payout for beneficiaries.

A window/time the insurer gives to the policyholder to review and cancel the policy without surrender charges.

The evaluation process insurers use to check your health, lifestyle, and other factors to determine your premium and application approval.

The COVID-19 pandemic served as a wake-up call, reminding us how life can be unpredictable. It brought to light the need to secure our family's financial well-being in the event of any unexpected situations. Purchasing term insurance post-COVID is no longer a choice—it's essential. A term plan guarantees that in the event of your untimely death, your loved ones will not suffer financially.

The pandemic also introduced increasing medical expenses, and hence financial security became even more important. Furthermore, term insurance is one of the most cost-effective methods of availing high coverage while providing peace of mind without depleting your finances.

Here's a simple guide on choosing the best term insurance plan with the right sum assured for your family.

Buying term insurance is a long-term commitment you make. Calculate your life coverage with the ACKO insurance calculator and get accurate premiums and life insurance.

To calculate your term cover Click Here

The sum assured is the prime factor in a term insurance policy, as it forms the actual amount the insurance company pays out to the beneficiaries in case of the death of the policyholder. Here's why it is an important factors:

Term insurance provides much-needed financial support for your dependents in case you are not around. The sum assured ensures that your dependents have enough resources to meet living expenses, pay off debts, and achieve life goals with minimum disruption.

The selection of an adequate sum assured is of prime importance to ensure the sufficiency of cover for the family. This amount should be enough to replace your income and cover future expenses, such as children's education or mortgage payments.

Knowing your loved ones were well taken care of and that the sum assured would financially secure them would give you peace of mind.

It is important to select an appropriate nominee for your insurance policy because such a person will be given the claim amount in the event of a tragic incident. Normally, policyholders nominate their spouse, children, or parents so that financial security is provided to their loved ones. Even a legal heir or a responsible person can be nominated if necessary. It's vital to change your nominee information over time, particularly after major life events such as marriage, childbirth, or a loss within the family, to ensure the right person receives the benefits without legal hassles. Making an informed choice ensures that your family's financial health is kept safe when they need it most.

Choose term insurance smarter with city-specific insights on coverage, costs, and the protection your family truly needs.

The Supreme Court of India has ruled that failing to disclose existing life insurance policies when purchasing a new one can lead to a claim being rejected. In one of its recent judgments, a claim was repudiated due to the policyholder’s failure to disclose multiple existing policies. Insurers assess risk and premiums based on full disclosure, including the Human Life Value (HLV). Non-disclosure can result in policy cancellation or claim denial. This ruling highlights the importance of declaring all existing life insurance policies to avoid future complications.

"I wanted a reliable term plan for my family’s financial security, and ACKO delivered exactly that. The online process was so easy, and I didn’t have to deal with any paperwork. It’s a great option for anyone looking for a stress-free insurance purchase."

What I appreciated about ACKO Term Insurance is the transparency and affordability. Just a simple and trustworthy plan. I feel secure knowing my family is protected.

Since I needed a flexible term plan that meets my requirements, and ACKO Life Flexi Term Plan was a great choice. The entire process was online, and I received my policy faster than i Imagine. Highly recommend it!

ACKO Term Insurance is great coverage at an unbeatable price. I explored around and compared several policies before I selected this one, and I'm glad I did. The claims process appears to be simple as well, which is reassuring.

I always thought purchasing term insurance would be complicated, but ACKO made it very simple! The website was easy to navigate, and the policy information was well explained. I now feel secure financially with the knowledge that my family members are covered.

“The ACKO Life Flexi Term Plan is unique in its flexibility and affordability. I loved the fact that I could tailor my plan to suit my needs. No agent persuasion—just a hassle-free online purchase experience!”

“Choosing ACKO Term Insurance was a smart decision. The premium is budget-friendly, and the policy offers great benefits. Plus, the online purchase was super convenient. I’d definitely recommend it to anyone looking for a reliable term plan!”

"I recently purchased the ACKO Life Flexi Term Plan, and I’m really impressed with the hassle-free online process. The premiums are affordable, and I feel secure knowing my family’s future is protected. Highly recommend it!"

Rated 4.6/5 with over 13377 reviews on Google

See all reviews

Here are some common questions about Term Plans in India.

Disclaimer: The content on this page is generic and shared only for informational and explanatory purposes. It is based on industry experience and several secondary sources on the internet, and is subject to changes. Please go through the applicable policy wordings for updated ACKO-centric content, and before making any insurance-related decisions. For full disclaimer kindly click https://www.acko.com/life/disclaimer/